Think your child will attend college or trade school in New Jersey? (Rutgers, Princeton and DeVry are among the many accredited schools in New Jersey).

If so, you should consider the potential benefits of a NJ 529 Plan, and whether they make sense for you* and your family*. A key benefit of both NJ 529 plans is the NJBEST Scholarship.

*Either the child or the account owner must be a NJ resident.

The NJBEST Scholarship is not need-based, means-tested, or merit-based; it rewards you for simply opening a NJ 529 plan and saving.

To be clear, here at AboveBoard we don't love either NJ 529 plan. The NJ Advisor-Sold 529 Plan (aka "The Franklin Templeton 529 Plan") earns our lowest rating of "Not Recommended" and the NJ Direct-Sold 529 Plan (aka NJBEST 529 Plan) earns a rating of "Just OK, Good in Some Situations". Check out our interactive College Savings Guide for more detail.

When is the NJ Direct-Sold 529 Plan A Good Idea?

That "Good in Some Situations" part or our rating applies to people who:

- Are NJ residents themselves or are opening a 529 plan for a NJ resident beneficiary, and

- Believe there's a good chance the beneficiary (aka "student") will attend a New Jersey school during their first semester of higher education, and

- Expect to contribute at least $1,200 to the account (the minimum required to get the scholarship), and

- Open the 529 plan at least 4 years prior to the student's first semester of higher education

For families who expect to apply for New Jersey state financial aid, there are some additional financial aid benefits of a NJ 529 plan, which we talk about here.

What Do You Get From the NJBEST Scholarship?

The NJBEST Scholarship offers a one-time scholarship during the student's first semester of higher education, if that first semester is at an accredited NJ school. The amount the student receives is determined by:

a) How long the account has been open, and

b) How much money has been contributed

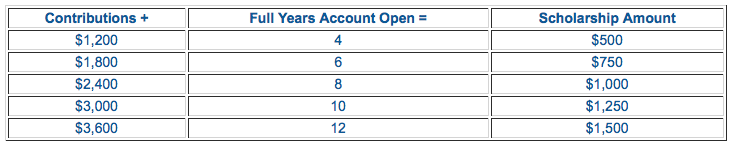

Scholarships range from $500 to $1,500, based on this chart. You must technically meet both the "contributions" and "full years account open" requirements to earn each level of benefit:

Source: New Jersey Higher Education Student Assistance Authority

This scholarship is not need-based or means-tested. You earn it by opening an account and saving.

The biggest and most important variable is how long you've had the account open - you need to have the account open for 12 years or more to maximize your benefit. But you can still earn a scholarship with an account that's been open for 4 years.

NJBEST Scholarship: Making Sure You Cross the T's & Dot the I's

If you're thinking, "this sounds interesting, I think I would value this NJBEST Scholarship," then you need to read on.

(If that's not you, head to our interactive College Savings Guide to figure out what's right for your situation and goals.)

There seems to be a difference between the technical rules of the NJBEST Scholarship and how it's currently administered.

Here's what you should do to be confident your child will qualify for the scholarship: open the account with $1,200, or contribute a minimum of $300 for each year that you want to earn credit in the table above.

Why? This is what the New Jersey Administrative Code excerpted in the 529 plan disclosures says you have to do.

But what should you do if that doesn't sound financially possible for you right now? By all means, open the account ASAP. That "timestamp" seems to be the most important factor in determining your child's rewards.

We've heard credible reports of people who did not steadily contribute this much earning the scholarship, so long as they opened the account enough years ago AND eventually contributed the required amount.

Get more honest, facts-based analysis of your college savings options with our interactive College Savings Guide.