You might think that above a certain level of wealth, people are only served by smart, ethical finance professionals.

That would be wrong.

Here I examine how a (previously) trusted advisor ripped off a highly successful finance executive, someone who has both the aptitude and expertise to understand what’s happening, but simply lacked the time to police every decision being made by their advisor.

This finance executive is a New York resident, so they (along with their spouse) are entitled to up to a $10,000 deduction on their New York state taxes when contributing to a New York 529 plan. At the highest New York state tax bracket for married couples filing jointly at the time, that was worth $882 / year.

When they told me they had a Maine 529 plan, I had some questions.

Reasons You Might Open an Out-of-State 529 Plan

Reason |

Does that reason apply here? |

| Your state doesn’t offer a tax deduction | Nope, NY offers a generous deduction |

| Your state offers a tax deduction for contributions to any state’s 529 plan | Nope, NY only offers the deduction for contributions to a NY 529 plan |

| Your state’s 529 plan(s) have high fees or subpar investment performance | Nope, the NY Direct-Sold 529 Plan by Vanguard charged 0.15% / year on account balances at the time, among the cheapest in the nation. The investment choices are from Vanguard, tied to major, well-diversified indices |

| You believe the investment choices available in an out-of-state plan will – after fees - outperform the investment choices available in your state’s plan, even though your state offers a generous tax deduction and low-cost index investment choices (as NY does) |

This is possible, just as it is possible your child is the next LeBron James: possible, but very unlikely. Over the 10-20 year timeframe you might have for a 529 plan for your child, it’s unlikely that an actively managed fund will outperform a low-cost index strategy. |

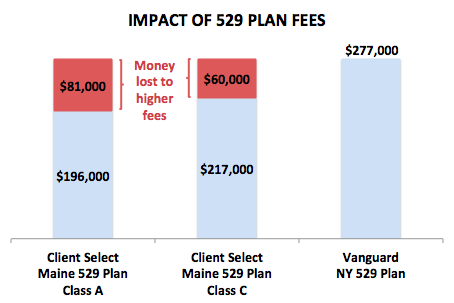

I could see it was a high-cost plan from the plan description, with the Class A & Class C shares having annual asset-based fees up to 1.31% & 2.06%, respectively. The Class A shares carried a hefty initial sales charge on all contributions of up to 5.25%, too.

High Fees = Bad News* (*Most of the time)

High fees are like termites that eat away at your investments.

You can see the negative effect on their children’s college savings, assuming investment performance was equal across all the choices:

Assumes: $100,000 invested, 6% assumed annual market appreciation, Fee structure of A shares: 3.5% front-end load + 1.32% annual fees, Fee structure of C shares: 0% front-end load + 2.07% annual fees, Investment time horizon: 18 years.

Look at how much less money their kids would have by the time they got to college. And the parents missed out on New York state tax savings -- painful!

I suggested the finance executive send an email like this:

Hi,

Wanted to check in with you and better understand the rationale for our having the Maine 529 plan.

As I understand it, New York offers a tax deduction on $10,000 / year (so up to $882 / year potential savings) and only recognizes contributions to the New York plan.

The New York Direct Plan charges a total of 0.16% / year for any portfolio, and the portfolios are Vanguard index funds. That's an all-inclusive fee, with no sales charges either on the front or back-end.

The Maine 529 Client Select Plan has much higher fees and we don't get any tax deduction. Could you please advise on why having a Maine plan makes sense for us?

Thanks.

Then the reply came in (I’ve added the bold font for emphasis):

We did indeed consider both options and the conclusion was that the investment options available under the Maine plan were significantly superior to the NY plan. The plan offers the largest available amount of investment options from a wide variety of investment managers. That allows us to better diversify our investment holdings and the difference in expected return over time should more than offset the tax deduction. We structure our 529 plan investments to avoid the occurrence of a major drawdown such as what occurred in 2008.

One last thing to note is that if you do move from New York they can demand back the tax deduction.

Let’s unpack those vague and unsubstantiated assertions:

| Financial Advisor Says: | Questions You Should Ask: |

|

Superior investment performance: “significantly superior investment options” “the difference in expected return over time should more than offset the tax deduction” |

Significantly superior on what basis? Can you provide me the analysis you ran – prior to advising me to invest in these securities – that led you to this conclusion? How do you track if the expected outperformance has actually been happening? |

|

Superior diversification: “largest available amount of investment options from a wide variety of investment managers” “better diversify our investment holdings” |

Why does a large number of investment options matter? Broad choice alone doesn’t get you anything - to invoke a Dilbert cartoon I recall: multiple cows with mad cow disease is a form of diversification but hardly a good one Diversification on what basis, and how is the diversification different from what's available with Vanguard? (Vanguard funds offer diversification of asset class, geography, investing style, etc.) |

|

Superior risk profile: “we structure our 529 plan investments to avoid…2008” |

Specifically, how is that done? How you define downside protection goals and measure if your strategies are working in future market downturns? This plan appears to have been in place since 1999 – how did 2008 actually go? |

|

Superior tax treatment: “if you do move from NY they can demand back the tax deduction” |

Could you please send me a link to the relevant tax statute or instructions?* *I'll clarify this point here: the advisor's assertion is just wrong. Here’s how it actually works: NY claws back the tax deduction and the state taxes you avoided on any gains if you roll over your NY 529 plan balances to another state’s 529 plan. But there’s no good reason to do this. If you ever moved out of NY, just let your NY 529 plan balances be, and make a decision about whether you wish to open a 529 plan in your new home state for any future contributions (vs. continuing to contribute to your NY 529 plan) |

You might not be shocked that no analysis was forthcoming.

But this vague missive arrived:

This plan is unique in its design including many levels of oversight. There is plan level oversight where if a fund or fund family underperforms they are replaced automatically and then of course we track performance and allocation. Almost all single state funds are designed with one fund family which doesn't give you much of a choice since they are not going to replace their own underperforming investment option.

This obfuscation is classic: start making things complicated, use vague yet positive terms like “many levels of oversight” and “we track performance”, invoke fear of things going wrong.

Where is this advisor’s oversight and tracking performance of their clients’ investments?

The advisor was not providing any concrete evidence of a good faith, competent attempt to select good investments.

My hypothesis was that this advisor was ripping off their client. But I’m always open to the possibility that facts might disprove my hypothesis.

I asked the finance executive to send me the tickers in the 529 plan account (the "initials" that allows you to identify what securities you own), to see what kind of investments and performance resulted from all these vague, positive (yet unsubstantiated) attributes.

Four tickers came over, and the results were not encouraging: with a menu of over 50 fund choices, all the selections came exclusively from the most expensive 10% of funds.

Was that because these funds were such stellar outperformers, that after the fees (and the forgone tax deductions, don’t forget) the client would come out ahead?

Nope.

The funds had not "earned their fees". As is typical, they underperformed their benchmarks.

I looked at the performance of these funds vs. Vanguard NY 529 plan alternatives – there was no way this plan had even come close to beating Vanguard.

For all the talk of better performance, more oversight, etc., there was no evidence of any benefit to the client – in fact, just the opposite: the client lost even more money.

I could also see from the plan disclosure how this advisor was getting paid: a good chunk of 1% of upfront contributions, plus 1% annually of total balances.

When I laid this out for the executive, they understood immediately what was going on, and were understandably unhappy with the advisor. They correctly noted that one should be able to trust an advisor. For a client like this finance executive (someone who has the ability to manage their own portfolio), a key goal of hiring an advisor is to not spend much time on one's own investments...unfortunately that only works if the advisor is highly competent and ethical.

Conclusion

While there are outstanding professionals out there, at no level of wealth are you safe from people trying to rip you off. If anything, it gets worse because there’s enough money involved to attract people who are very smart, have resumes full of elite institutions, and are smooth and well-trained enough to rip you off gracefully.

Staying focused on facts-based answers, supported with appropriate quantitative analysis, are all great ways to ferret out whether your advisor is making highly competent, ethical judgments on your behalf.

Here at AboveBoard, we offer smart and ethical insurance advice across life, disability and long-term care insurance. We collaborate with like-minded, client-first professionals (e.g. financial advisors, estate planning attorneys, etc.) to ensure that clients are receiving the best insurance advice. Learn more about working with us as a Private Client or get a life insurance quote to start exploring the possibilities.