Published 9/27/2022

As a New Yorker, this is a topic I am focused on for myself and my family. I wanted to share this, so you have the opportunity to make an informed decision, too. If you'd prefer to watch a short video, head over here.

What’s happening?

If you’re employed in New York state you might find yourself paying an additional payroll tax in the not-distant future – unless you are able to qualify for an exemption.

That’s because the New York State Senate has introduced draft legislation for Senate Bill S9082: The New York Long Term Care Trust Act.

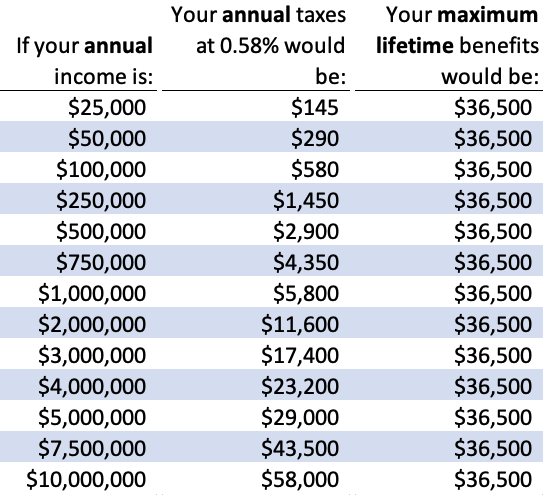

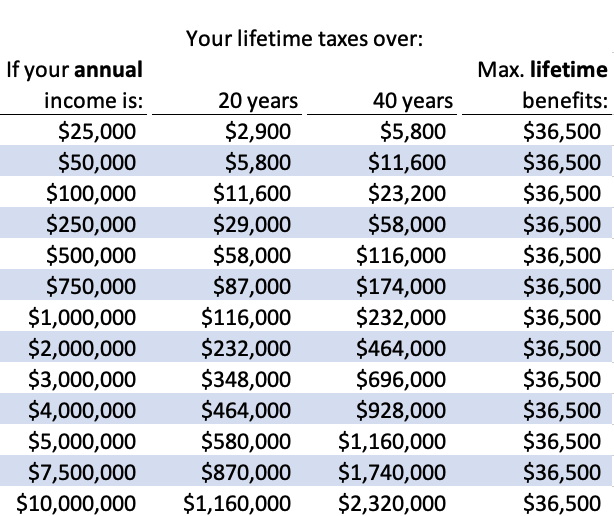

The bill proposes a payroll tax to fund a New York state-run long-term care insurance program. The amount of the payroll tax is currently unspecified - and uncapped - for New York employees. (If New York state mirrors a similar law from Washington state, the payroll tax would be 0.58% of all compensation. More on this below.)

While the tax you could pay is uncapped (limited only by your income), the long-term care benefits would be limited to receiving a maximum of $100 / day for up to 1 year – a maximum potential benefit of $36,500.

The bill currently includes an exemption from the payroll tax if you prove you have had qualifying private long-term care insurance continuously since January 1 in the year the bill is enacted.

Importantly, whether you are exempt would be based on whether you already had coverage when the legislation passed; you would have no window to obtain coverage after the legislation is passed.

For example: if the bill becomes law on June 13, 2023, you would only have a shot at an exemption if you had held qualifying long-term care insurance since January 1, 2023.

If you do not have a qualifying private long-term care policy today, then you would need to get one in place during 2022 in order to have a chance at an exemption if the bill passes in 2023.

How do I qualify for an exemption from the proposed payroll tax?

If you are not self-employed, you may qualify for an exemption if you prove you have had qualifying private long-term care insurance continuously since January 1 in the year the bill is enacted.

This means that you would have to have a qualifying private long-term care insurance policy in place before the legislation is passed.

If you are self-employed, you are exempt, but - if you wish - you may choose to opt into the program by voluntarily paying the required payroll tax.

How much is the proposed payroll tax?

The draft legislation does not say. It states the rate will be announced months after the legislation is passed.

Recent legislation in Washington state may offer a clue: Washington’s law implemented a program that will charge 0.58% of income running through your W-2, and this amount can be adjusted in future years.

Here’s how that math would look, if New York decided on the same level of payroll tax as Washington state:

You should consider how long you might pay into the program.

Note: the above chart assumes that the current draft New York Senate bill passes as written, and New York state subsequently decides to set the rate of the payroll tax at the same level as Washington state’s 2021 legislation. While both the payroll tax and the maximum benefits can be raised in the future, this chart assumes a constant level for illustrative purposes. To get a sense of how these payments compare to private long-term care insurance policies, check out 3 Steps to Make the Right Long-term Care Choices in New York State: Private Coverage vs. New York Long Term Care Trust Program?

Why should you act now?

If the bill passes as currently drafted in 2023, then you would need to have gotten a qualifying private long-term care policy in 2022 (or prior) to qualify for an exemption.

Specifically, the bill includes an exemption from the payroll tax if you prove you have had qualifying private long-term care insurance continuously since January 1 in the year the bill is enacted.

When we say “act” we mean understand what your long-term care insurance options look like, so you can make an informed choice about if private long-term care insurance makes sense for you.

What could change?

In a word, everything. This is an evolving situation because this is a bill that has been drafted and is currently in the New York State Senate, it is not yet law.

However, depending on your personal situation - financial, how long you expect to reside in New York or work for a New York state employer, etc. - it could be advantageous to consider obtaining your own private long-term care coverage in calendar year 2022.

I already have long-term care insurance coverage – will I be exempt?

You might be, but you might not be. As currently drafted, the legislation appears to give credit for some long-term care insurance policies but not others.

For example, a permanent life insurance policy (i.e. whole life, universal life, variable life) with a long-term care rider would almost certainly not count. Some hybrid life-long-term-care policies would also not count.

A traditional long-term care insurance plan currently seems like the highest probability of qualifying for an exemption.

To learn more about these different types of long-term care insurance, check out Long Term Care Insurance: A Quick Primer.

I’m interested in looking at my options – what’s next?

You can get started in several ways, choose what works best for you:

A) Get a long-term care insurance quote (you'll have the opportunity to schedule a call with a licensed expert, too)

B) Email concierge@aboveboardfinancial.com to schedule a call to answer your questions

C) Already an AboveBoard client? Just reply to any email from us and let us know you want us to round up your NY long-term care options!

For some employees, private coverage will be the best option. For others, the opportunity to participate in a government-run program will be the best option.

At AboveBoard, we are committed to giving you honest advice about your options and what does - and does not - make sense.

Experience the AboveBoard difference - get smart and ethical insurance advice.