In a previous post, I wrote about a new, uncapped payroll tax that was introduced in a bill to fund a New York state-run long-term care insurance program (for more context, check out Must-Read for Employees in NY State: What the New York Long-term Care Trust Program Could Mean for You or watch this 3-minute video).

The bill, as currently drafted, offers an exemption from the payroll tax if you have private long-term care insurance in place by January 1 of the year the law becomes effective (so if the bill were to pass in 2023, you would need to get long-term care insurance in 2022 to qualify for the exemption). As a New Yorker, you’re probably asking "what - if anything - should I be doing about long-term care insurance in 2022?". We’ll walk you through 3 quick steps to figure out whether you should take action now.

People who stand to gain the most from taking action in 2022:

- Higher-income employees who could get a better long-term care policy for lower premiums than the potential payroll tax (at $350k+ household income, it often makes a lot of sense)

- Employees who have many decades of their careers ahead of them, and thus expect to pay in more than they might ever get back from the proposed public insurance program

- Self-employed and currently-not-employed individuals who, while exempt today, might become W-2 employees who fall into groups #1 or #2 in the future

- Employees who are unlikely to remain in New York state in retirement and/or prefer coverage that is independent of a particular state government entity

- People who prefer a policy where benefits are triggered by being unable to perform two, rather than three, of the six “activities of daily living”

- People who decide they want long-term care insurance coverage, regardless of whether the New York Long Term Care Trust Act passes or not

Many people will find they fall into more than one group above.

If you already know that a private long-term care insurance policy would be a good deal for you and you’re ready to get started, get a quote.

If you’re curious to learn more about what coverage costs in the private insurance market, and how that compares to the proposed government program, here’s a 3-step guide to help you decide if you want to explore private long-term care insurance alternatives:

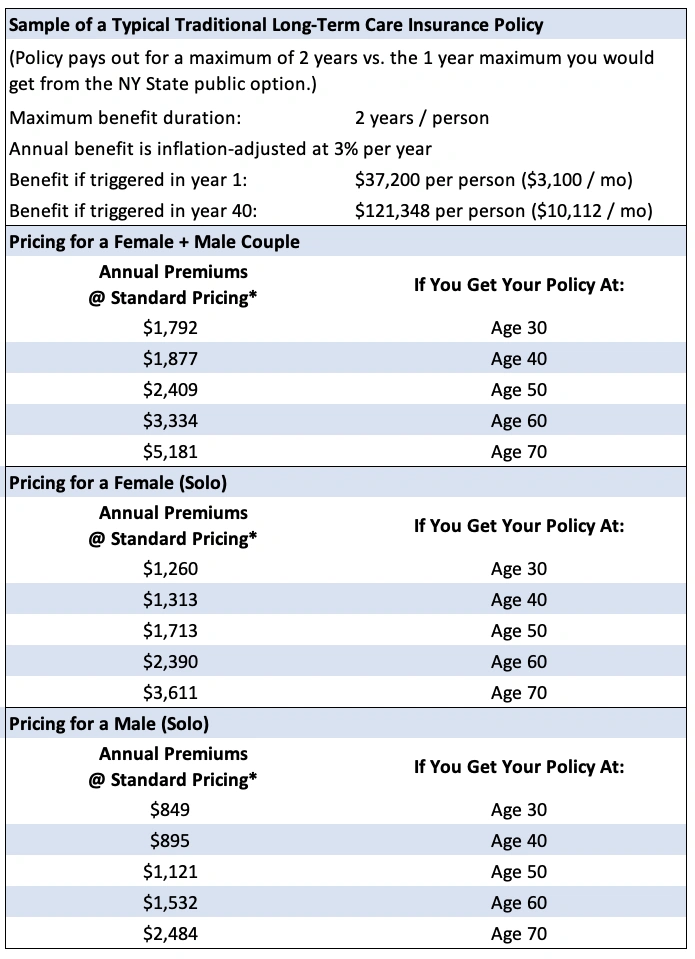

Step 1: Get a Sense of How Much Private Long-Term Care Insurance Might Cost

Long-term care insurance rates vary by age, sex, health profile and whether or not you are eligible for a partner discount (couples can get 15% off).

There are 3 profiles with quotes below:

- Male-female couple (male-male couple rates will be ~20% less, female-female couple rates ~20% more)*

- Single female

- Single male

*Women's long-term care insurance rates are higher than men's rates because women are more likely to need long-term care and have longer-lasting long-term care needs.

Take a look at the category that most closely matches your current situation. Find the premium price noted in the chart. This will give you a rough idea of what could be available to you.

*The rates shown above are “Standard” rates, lifetime-pay premiums. Some people will qualify for Preferred rates and get a 15% discount. Other people who have some extra factors in their own medical profiles or family history will get offered coverage that is ~25%-50% more than Standard rates. Some people will not qualify for coverage at all. Some policies allow you to reduce your coverage in the future and/or decide you wish to stop paying in exchange for a benefit that is lower than if you continued paying.

You can get a quote to find out what pricing you are likely to get, and which policy features are the best fit for your situation.

Keep in mind that applying is no-obligation: once you have an offer, you can decide if you want to accept it. Applying is a way to find out what’s definitely available to you.

Do you have an annual dollar amount of premiums in your mind? If so, you’re ready for step #2.

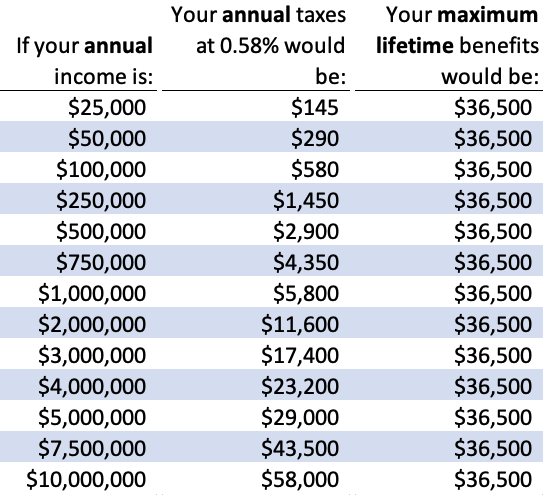

2) Compare the number from Step #1 to your estimated annual contribution below.

The draft New York Long Term Care Trust Act does not set a rate for the payroll tax, but the bill has many similarities to an existing program in Washington state, including the same benefits. Therefore, we use the rate charged in Washington state, 0.58% of W-2 earnings, to estimate your potential contribution in New York. Your actual contribution could be higher or lower, depending on what happens in the future.

You can estimate 0.58% of your own earnings or use our table below as a quick reference:

If you’re doing this as a part of a couple, be sure to consider household income.

Depending on where you are in your career, you might want to look at income levels that are higher or lower than where you are today.

Ask yourself: how does my number from Step #1 (potential premiums) compare to my number from Step #2 (contribution to the public program)?

When comparing your options, consider that the quotes above are for policies offering a benefit for up to two years (the minimum with private insurance policies in New York) versus the proposed public insurance program offering one year of benefits.

If you would definitely like to explore private long-term care insurance options, get a quote.

If you’re not sure, continue to Step #3.

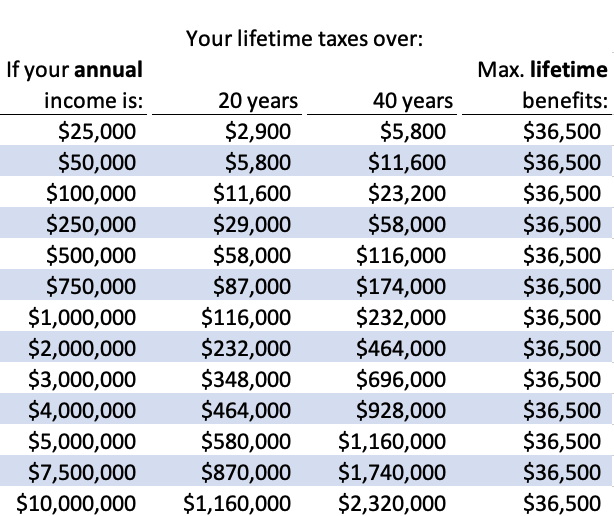

3) Compare your estimated lifetime contribution to the benefits under the public option

Consider how much you would pay over your working life. Compare that to the benefits available under the program, $100 / day for 365 days, or $36,500 in total.

The benefits grow with inflation by default, but a committee can choose to raise them by a different amount if they vote to do so. The contribution rate (which we’re assuming is 0.58%) can also change over time.

Here’s a table you can use to estimate your lifetime contribution:

Ask yourself: do I feel like the potential public insurance program is a good deal for me? Or might I be better-served by a private long-term care insurance policy?

If you would like to explore your private long-term care insurance options, get a quote.

If you’re still thinking about it, here are some additional resources:

- Must-Read for Employees in NY State: What the New York Long-term Care Trust Program Could Mean for You

- 3-minute video covering the New York Long-term Care Trust Program

- Long-term Care Insurance: A Quick Primer (not specific to New York state - while all types of long-term care policies mentioned in this post are available in New York state, note that not all of them would qualify for an exemption)