If you carry a balance on your credit card from month to month (meaning you're not paying it off completely), then you need to look at your statement and find these 3 things.

Not knowing could be costing you A LOT of money.

Seriously, go get your statement now. Download it from the website, pull it out of the envelope, take it out from the bottom of the hamster cage (ick, I hope it's not there!)...wherever it is, go find it now!

Different credit card issuers have slightly different ways to providing the info, but are all required by law (thank you, CARD Act!) to tell you these 3 things.

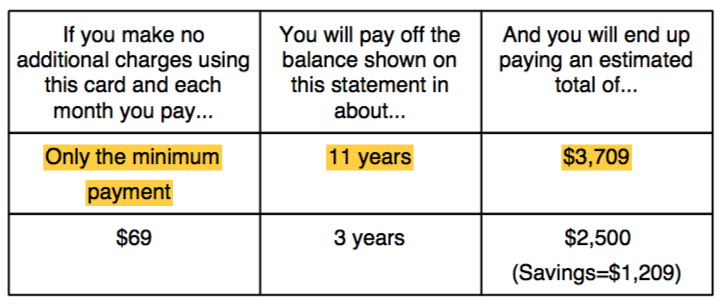

1) How long it would take you to pay off the balance in full if you only paid the minimum payment

The minimum payment is what you must pay to remain in good standing with the credit card company.

This amount should be on auto-pay so that you don't accidentally end up in bad standing (which is also super-bad for your credit score).

Example:

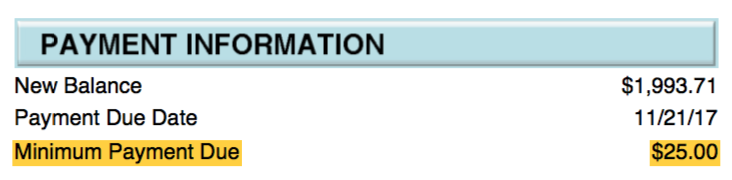

Unsure of how much your minimum payment is? That is on your statement, too. It'll look something like this:

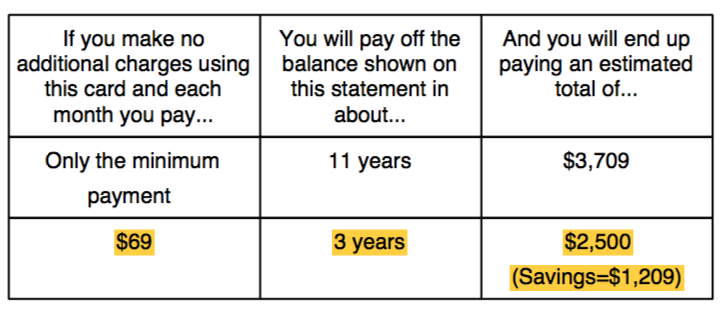

2) How much you'd have to pay each month in order to pay off the balance in 3 years

This is a good number to know so you can target paying at least that amount or - even better - more.

The CARD Act also requires the credit card companies to tell you how much you'd save paying this amount, compared to making the minimum payment. YES, they must do the math for you. Awesome!

Example:

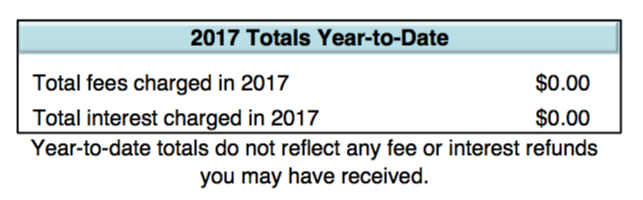

3) Interest and fees charged in total year-to-date

Example of what this looks like:

This card is an example of a card paid in full each month, so fees and interest are zero.

This is your goal. You work hard. You want the credit card companies to take as little of it from you as possible.

Want clear, honest insights on how to get your financial life under control and in good shape? Check out our Financial Action Plan.