Term life insurance and whole life insurance are two different coverage types, each with their own pros and cons. Read on to learn whether term life, whole life, a combination, or a different type of life insurance makes the most sense for your financial situation, coverage needs, and goals.

What is term life insurance?

Term life insurance covers you for a portion of your life.

Term life insurance only pays a death benefit if you die during the term.

Most term life insurance is “level term,” which means the premiums are fixed and cannot change for the duration of term. For example a policy with “$1,000,000 of coverage and 20 year term for $28.38/month” means you will spend $28.38/month on the premium for the entire 20 years if you choose to keep the coverage for that long.

Some term life insurance is “annually renewable,” which means the premiums increase each year. The yearly premium increases can be considerable, especially as you age. It is generally better to get a level term policy than an annually renewable policy, because it is easier to plan your household expenses around.

You can drop your term coverage without penalty anytime you want. Think of term insurance as similar to a Netflix subscription: you keep paying for it as a long as you need or want it, but if you decide you don’t need it anymore, you just stop paying and it ends.

What is whole life insurance?

Whole life insurance is a type of permanent life insurance.

You often hear “whole life” and “permanent life” used interchangeably, but that’s not technically correct. Whole life insurance is a type of permanent life insurance, just like chocolate ice cream is a type of ice cream.

All types of permanent life insurance are intended to cover you from the time you purchase the policy until you die, so long as you pay the required premiums.

Permanent life insurance pays a death benefit whenever you die.Permanent policies, including whole life policies, offer different choices about how long you have to pay the premiums. Common options are paying only the first 10 years (“10 pay”), only the first 20 years (“20 pay”), and paying your entire life (“lifetime pay”).

Whole life insurance is one of the more traditional types of permanent life insurance. Whole life insurance:

- Is not flexible—required premiums must be paid to keep the policy going

- Has cash value—cash value is the value in the policy that you can access while you’re still alive. Cash value earns a guaranteed rate of interest and, in some policies, is eligible to receive extra returns called “dividends.”

- Pays dividends—some, but not all, whole life policies offer you the opportunity to receive “dividends.” These are additional returns from the policy that can be used to grow the cash value and death benefit faster, offset premiums, or be taken out of the policy to spend (but look out for income tax if you take out more in dividends than you pay in premiums)

Whole life policies have a “surrender value,” which is the value you would get back if you decided you no longer wanted the policy. However, you almost always lose money when you surrender a whole life policy. Surrendering can be the best of several not-great options, but it’s important to go into a whole life policy with confidence that it truly makes sense as part of your total financial picture.

What is the difference between term & whole life insurance?

Here’s a quick breakdown of the key similarities and differences between term and whole life insurance.

|

Term |

Whole |

|

|

Covers your entire life? |

No |

Yes |

|

Pays a death benefit to your loved ones if you die while insured? |

Yes |

Yes |

|

Has cash value (money you can access while you’re alive)? |

No |

Yes |

|

Premium cost |

Lower |

Higher |

|

How long you’re covered |

A fixed period of time (10, 15, 20, 25, 30, 35 or 40 years) |

Until age 121* |

|

Easy to cancel if your needs change? |

Yes |

No |

|

Good for replacing the income or care you provide if you were gone? |

Yes |

Yes |

|

Good for planning an inheritance for your loved ones? |

No |

Yes** |

|

Good for supplementary retirement income? |

No |

Yes** |

|

Good if you feel like “money is tight”? |

Yes |

No |

|

Good if you feel like you are financially on track? |

Yes |

Maybe** |

*Double-check to be sure that any quote you’re looking at is guaranteed this long—not all whole life policies are.

**Whole life insurance can be a great way to achieve these goals, but there are other approaches, too. As a general rule, you should prioritize saving for retirement account(s), such as 401k and IRA, before focusing on whole life insurance.

What type of life insurance is best for you?

Spoiler alert: for most people, term life insurance will be the right choice. A good rule of thumb is: so long as you buy enough term life insurance, your loved ones will be protected in the worst case scenario. You can learn more in our post on why term insurance is the right choice for most people.

Whole life insurance can be great when used in the right situation and in the right amount. Think about your one most important goal with life insurance coverage. Here’s a quick guide to what type of insurance is likely the best fit for you.

|

If your top goal in getting life insurance is ... |

then you should probably choose: |

|

replacing the income you earn for your loved ones if you died |

term |

|

replacing the care you provide to loved ones if you died |

term |

|

not leaving debts behind that would burden your loved ones |

term |

|

tax-advantaged supplementary retirement savings |

whole (or another type of permanent insurance) |

|

leaving an inheritance |

whole (or another type of permanent insurance) |

|

building an estate plan—you’re working with an attorney to pass money to future generations |

whole (or another type of permanent insurance) |

If you feel like two or more goals are important to you, then the right answer for you may be to choose some of each insurance type.

Whole life insurance may not be right for you if:

- You carry a balance on your credit card and do not pay it off in full each month

- Money feels tight from month to month

- You are not yet contributing to a retirement plan, such as a 401k, 403b, Roth IRA, IRA, etc.

- You have children and want to save for their higher education, but are not yet saving anything in 529 plans

Whole life insurance may be right for you if:

- You are already saving the target amount in your tax-advantaged accounts (401k or IRA for retirement, 529 plan for college savings, etc.)

- You have extra savings left over each month after hitting your savings goals

- You are doing estate planning and a policy with cash value makes sense as part of your strategy

Whole life insurance can be great when used appropriately, but be sure you’re putting life insurance in the context of your total financial picture and not missing out on even better ways to achieve some of these goals. Use our free Financial Action Plan to get customized recommendations for how life insurance fits into your total financial picture.

If you’re not ready for a whole life policy today but feel like one might make sense for you in the future, there are some term policies that allow you to convert to whole life (and/or other types of permanent life insurance coverage), which can be a smart way to set up a “placeholder” for your future self. We talk more about the “conversion option” later. You can learn more about when permanent life insurance is a good idea in When does permanent life insurance make sense?

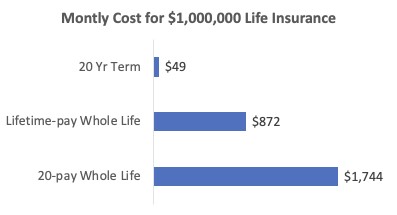

Cost comparison: term vs. whole life insurance

Any term insurance policy that you can qualify for will be much less expensive than any whole life policy you can qualify for.

Why is that? Statistically, you’re highly likely to outlive any term policy you qualify for. You’re buying the coverage just in case you are among the unlucky few who do not outlive your term.

With permanent life insurance, the insurance company is obligated to pay a death benefit whenever you die (so long as you pay your premiums), and—as the old saying goes, nothing is certain except death and taxes.

Take a look at this pricing for a healthy, 38-year-old male non-smoker. It compares three things:

- Term life insurance with a 20 year term

- Whole life insurance with lifetime pay (you pay premiums each year you live)

- Whole life insurance with “20 pay” (you only pay premiums the first 20 years)

The 20 year term is so inexpensive precisely because this healthy, non-smoker 38-year-old male is extremely likely to live beyond the age of 58. He’s buying the coverage to protect his family from the worst case scenario if he were to be among the unlucky few who does not outlive his term policy.

Term life insurance is a lot like homeowner’s insurance: you buy it “just in case” but really hope that no one ever has to file a claim.

Whole life is a different ballgame: you are making a financial decision and paying to ensure that your loved ones definitely receive the death benefit whenever you die.

How long do I need term life insurance?

For most people, term life insurance serves to replace their income and/or the care they provide to loved ones in the event they die prematurely.

How long you need life insurance is driven by how long people will likely depend on your income and/or care. If you have children, this is often until your youngest reaches an age of independence. If you have a spouse who relies on your income, consider how long they would need your earnings to assure their own comfortable solo retirement. Our life insurance calculator will take in all of the key considerations and make a recommendation for you.

You can learn more about choosing the right term in Choosing the Right Term: How Many Years Do You Really Need Life Insurance?

Can I convert a term life policy to a whole life policy?

Most term policies have a “conversion option,” which gives you the right to convert your term policy into permanent life insurance without having to prove you are still healthy.

Some term policies allow you to convert to whole life policies, while others offer conversion to different types of permanent life insurance. If having the option to convert to whole life is important to you, ask your agent which policies include that option.

One thing to watch out for with term policies that convert to whole life policies is that a conversion option gives you the right to convert to policies that exist at a future date. So while you’re locking in the option to get some type of permanent life insurance, you are not guaranteed that it will be a whole life insurance policy. Some carriers are more committed to offering whole life than others, your agent can help you choose a carrier.

Conversion options can be really valuable in a range of health scenarios and financial situations—you can learn more about them in The Option to Convert Your Term Life Insurance to Permanent - A Smart Move or Not Worth It?

What are the pros and cons of whole and term life insurances?

Term life insurance and whole life insurance can each help you meet different goals, and it is really important to make sure you’re using the right type of policy for your goals.

Term Life |

| Pros |

|

| Cons |

|

*If your main goal is to make sure your loved ones are OK if you don’t live a normal life span, then this is not a problem for you; term would be a great choice.

Whole Life |

| Pros |

|

| Cons |

|

Conclusion

Like any other financial decision, choosing the right life insurance coverage is a matter of tailoring your coverage to your needs and goals.

If you’re ready to choose a term strategy, visit our life insurance calculator for policy recommendations; if you already know what coverage you want, skip ahead to requesting an instant online quote.

If you feel like whole life insurance might be the right choice for you, we recommend you check out our video Which Type of Permanent Life Insurance Is Right for You? or schedule a free 15-minute call.

If you are unsure, complete our Financial Action Plan and request a quote for permanent life insurance when you get an instant online quote. Our agents can advise you on how to fit the right insurance strategy into your total financial picture.