If you’re paying for life insurance coverage through work, you should take a look at your paystub and understand what you’re paying, and for what. For most people, it is a bad deal.

And if you have financial dependents (e.g. kids or a spouse who needs your support) and are relying on workplace coverage your employer pays for, that is most likely an even bigger problem. Our life insurance calculator helps you figure out how much coverage you should really have.

The most common reasons workplace life insurance is not your best option are:

- It’s expensive* compared to what most people can get in the individual life insurance market

- You often can’t take it with you when you change employers, and even when you are allowed, the terms are almost always awful (read: very expensive)

- The pricing typically goes up every 5 years*; this really sneaks up on people

- The odds are good that you’re also dangerously underinsured; workplace coverage rarely allows you to get enough coverage once you need life insurance

* This applies only to ”voluntary” or “supplemental” workplace life insurance, which is the kind you pay for. “Basic” is the kind your employer pays for. Basic is usually 1-2x your income - never rely on that once you have financial dependents.

Here at AboveBoard we come across this when we’re helping individual clients in our individual life business, as well as helping employer clients consider employee benefits offerings. So we see both sides.

It Sneaks Up On You: Beware the Escalating Workplace Premiums

Most workplace coverage goes up in price by age band every 5 years, so it becomes very expensive over the entire time that you actually need life insurance. If you’re in your 20s or early 30s, this might not have felt like much so far, but know that around age 35-40 the rates really start to skyrocket.

Here’s what the pricing from 5 major insurance companies looks like by age:

If you look at this chart and think, “great, I’ll go with workplace coverage early on, and get individual coverage later”, please be aware that’s definitely the wrong conclusion. Doing that would be a bad idea for a number of reasons.

Let’s look at an example of how choosing workplace coverage would work out.

“Death by a Thousand Cuts”: Losing $23,000, A Little Bit At A Time

This example uses actual pricing (aka quotes), both for the workplace and individual life insurance.

Example: A 30 year old woman plans to have a child soon. Her workplace coverage offers up to 5x her base salary in voluntary coverage, with a maximum coverage of $500,000. She makes $200,000 / year. It’s benefits enrollment season, she goes for the max - $500,000! She plans to figure out whether she needs more later.

The premiums don’t seem that high - only $14 / semi-monthly pay period! (Spoiler alert: this is not good.)

She likely needs coverage for at least 20 years, probably more like 25 or 30 years - so looking at 20, 25 and 30 year term would be a good choice in the individual life insurance market. (If you’re trying to figure out term for yourself, read Choosing the Right Term: How Many Years Do You Need Life Insurance?)

Most people who apply for individual life insurance achieve a pricing tier somewhere between 1st tier (aka “Best) and 4th tier (aka “Standard”). By contrast, workplace coverage is usually priced only based on age, not individual health and lifestyle.

Let’s take a look at how going with workplace coverage would have worked out for her, assuming she remains at her current employer or moves among employers with similar workplace offerings:

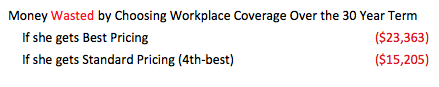

Yikes! Between $15,000 - $23,000 wasted by choosing workplace coverage. And her family was at risk to boot - $500k comes nowhere close to replacing her income (much less the income and care she provides for free) to her family.

Why did she end up losing so much money? That $28 workplace coverage monthly cost (the same $14 semi-monthly payment noted before) at age 30 will become $56 by the time she’s 40 and $134 by the time she’s 50! Could she just drop coverage then?

Probably not - 20 years from now sounds like a long way off, but her oldest will still be a teenager and, if she had more than one child, she likely has many more years of financial dependents ahead.

With Best pricing for non-smokers on an individual policy, she’d have had a steady payment of $26.63 / month!

You might be thinking, "What if she dropped workplace coverage at age 40 and bought individual coverage then?" This is a usually a bad bet, as the pricing available to her at age 40 would be much higher than what she could have gotten at 30.

Pricing goes up with age, even for a person who remains in excellent health. Additionally, relatively minor things - like the removal of several abnormal moles - can harm your ability to achieve great pricing. Major issues - like a cancer diagnosis, even if you make a full recovery - can make you uninsurable (sometimes for many years, other times forever).

When Workplace Coverage Can Be A Good Option

For people who are uninsurable (at least temporarily), workplace coverage can be tremendously helpful. This is unusual, but it does come up.

Workplace coverage can also be more attractively priced for people with more significant health or lifestyle considerations (including currently smoking), who are unable to qualify for Standard non-smoker pricing. However, you still have to be really careful about the risks of inadequate coverage and losing coverage from your employer. We help clients craft appropriate strategies when this comes up - sometimes a combination of individual and workplace coverage is best.

Sometimes, if you need a relatively modest amount of insurance (e.g. $250k) for a short period of time (5 years or less) and your employment situation is extraordinarily stable (i.e. the odds of you getting fired or quitting are super-low), then it can be a fine option, too.

So workplace coverage is not bad in all scenarios, but most people could do much better with individual coverage.

To learn about what options are available for you, visit our life insurance calculator if you are unsure what coverage you should have, or go straight to comparing quotes if you already know what you need!