As parents, we want what is best for our kids, but figuring out what is best is not always easy.

529 plans offer tax savings but they also reduce flexibility, because the money must be spent on what the IRS considers “qualified educational expenses” in order to receive the tax benefits. You might have even heard that there are penalties for not using the money on qualified educational expenses (true, but often misunderstood).

Parents often have many questions about 529 plans. We’ll answer 5 main questions parents have about 529 plans in this post.

What can I use the 529 plan money for?

Good news—529 plans are a lot more flexible than most people think. “Qualified educational expenses” include tuition, room and board, and essential supplies (such as textbooks, laptop, etc.) needed to attend post-secondary education. And post-secondary education doesn’t just mean college—it includes college, graduate school, and vocational school. In 2017, 529 plans were expanded to permit using up to $10,000/year per student for K-12 tuition.

Starting in 2024, it became possible to transfer money from a 529 plan to the beneficiary's Roth IRA, subject to annual Roth IRA requirements, up to a lifetime limit of $35,000 per individual.

Ask yourself: is the post-secondary education program my child is considering one that is authorized to accept US federal student loans by the US Department of Education? If so, you can use money from a 529 plan to may payments there (most higher education schools apply, but if you have any doubts, look up the school on the US DOE website).

How much are the tax benefits of a 529 plan actually worth to me?

The tax benefit of a 529 plan that everyone enjoys is that any growth of the money is not taxable when you use the money for qualified educational expenses. This generally applies to federal, state and local taxes.

An additional tax benefit in some states is that some or all of your contribution gets you a tax deduction or credit on your state income tax return. In some cases you also get a deduction on local taxes, such as in New York City. If you live in a state with no income tax, this benefit does not apply to you. Among states that have income tax, some offer benefits on 529 plans (such as New York) while others do not (such as California).

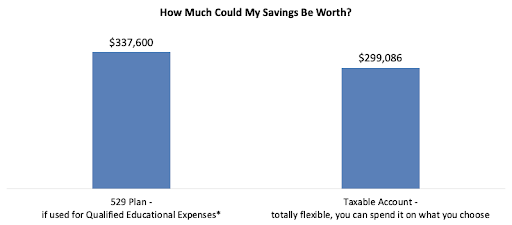

Here is an example of the federal income tax savings for one family that decides to save $10,000/year every year from birth of their child until the child starts their higher education (college, trade school, etc.):

*Qualified educational expenses include tuition, room and board, and expenses for essential materials (e.g., textbooks and computers) for post-secondary education (college, grad school, vocational school) at schools that are approved by the US Department of Education to accept US federal student loan money. Additionally, you can use 529 plan money on up to $10,000/year per student for K-12 tuition.

Note: the analysis above assumes 37% federal income tax rate, 23.8% capital gains tax on the taxable account, and 6% annual investment gains.

You can see above that the savings are meaningful—who wouldn’t want over $38k “extra” in their account when it comes time to pay tuition?

But the analysis above assumes that you have qualified educational expenses to spend the money on.

What happens to my 529 plan if my child does not go to college?

If your child isn’t going or might not go to college, ask yourself these questions:

- Is your child pursuing any program where the money can be used? Remember, 529 plan money can be used for K-12 tuition, as well as tuition, room and board, and necessary supplies at vocational schools and graduate schools

- Do you have more than one child? If so, it is easy to transfer 529 plan money between family members. The IRS has a (long) list of family members you can move the 529 plan money to!

- Do you want to pursue any educational programs yourself? If you decide that once your kids are out of the nest it’s the time to pursue your own educational dreams, you can move the money back to yourself

- Do you want to sit tight and hold the money for grandkids? Grandkids are also on the IRS’ list of approved family members to whom you can transfer 529 plan money

- Does it make sense to do a “non-qualified withdrawal,” i.e., take out the money but not use it for qualified educational expenses? If you go through questions 1-4 and do not feel like any of these uses of 529 plan money apply to you, then you still have the option of taking your money back.

What is a non-qualified withdrawal from a 529 plan?

Whenever you take money out of a 529 plan but do NOT use it for qualified educational expenses, that is called a non-qualified withdrawal.

If you choose a non-qualified withdrawal, keep in mind:

- You get back the money you put in, free and clear. It was your money to start with, and it’s still your money—no penalties

- If there are investment gains in the account, you will pay both income tax and a 10% penalty on your federal taxes*

- If you live in a state that offers state tax deductions or credits for 529 plan contributions, your state may take back those benefits from you in the form of taxes and penalties

*There are selected exceptions to the 10% penalty. For example, if your child attends a US military academy or receives a large scholarship. In those situations, you only owe income tax but not the 10% penalty.

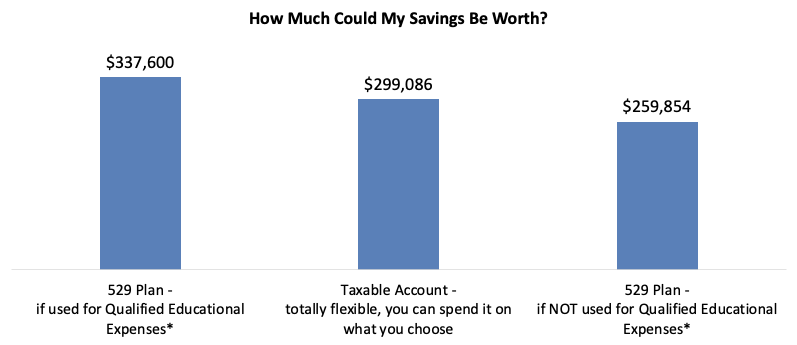

Let’s revisit the example above and see what would happen if this family had no qualified educational expenses to pay and needed to withdraw 100% of the money.

*Qualified educational expenses include tuition, room and board, and expenses for essential materials (e.g., textbooks and computers) for post-secondary education (college, grad school, vocational school) at schools that are approved by the US Department of Education to accept US federal student loan money. Additionally, you can use 529 plan money on up to $10,000/year per student for K-12 tuition.

Note: the analysis above assumes 37% federal income tax rate, 23.8% capital gains tax on the taxable account, and 6% annual investment gains.

You can see in the numbers above that if you end up taking everything back in a non-qualified withdrawal, then you would have come out ahead with a regular brokerage account.

You need to ask yourself how likely it is for you and your kids to have no qualified educational expenses in the future. Most families expect that—even if their kids’ future does not include college—it likely includes some sort of post-high school training program, and across multiple kids, the odds that someone will have qualified educational expenses are even higher.

A good rule of thumb: if you think there’s a higher than 50% chance that at least one of your kids will pursue higher education, then saving something in a 529 plan makes sense.

What happens if I do not use all the money in the 529 plan?

If you use some, but not all, of the money in your 529 plan, then you reap the full tax benefit on your qualified educational expenses, but you will have the same choices as noted above for the portion you are not going to use. You can transfer the money to a family member, let it sit in the account for “future family members” (e.g. grandkids not yet born), or make a non-qualified withdrawal.

The key takeaway

If you are at a place financially where you feel like your own retirement savings are coming along and you are ready to start saving for a child’s educational future, 529 plans offer excellent tax advantages. If you’re interested to see how saving for education balances with your other financial priorities, complete our fast, free AboveBoard Financial Action Plan.

If you feel that it’s a better-than-50% chance that at least one of your children will pursue some combination of private K-12, college, grad school, and/or vocational school, then a 529 plan could make a lot of sense for you and your family.

Make sure your dreams for your loved ones cannot be derailed

Earning income is essential to stay on track for your college savings goals.

Do you have the life insurance and disability insurance you need to ensure your family's dreams would not be derailed if you died prematurely or became too ill or injured to work?

Get a life insurance quote or a disability insurance quote to ensure that a health crisis would not become a financial crisis.