Having a taxable estate means that, upon your death, the government will tax your estate because it has assets that are above certain thresholds the government sets.

At the federal level, this typically applies only to families with significant assets: $30 million per married couple or $15 million per single individual in 2026. Those levels are currently set to rise with inflation in the future, absent a change in law.

(If you thought that the estate tax exemption was going to get cut in half on January 1, 2026, rest assured you did not imagine that. That used to be the case, but the One Big Beautiful Bill Act signed into law in July 2025 changed the rules.)

At the state level, most states do not have any estate tax or inheritance tax, but some do. It's important to check your state so you know the rules that apply to you.

Once you know the rules that apply to you at the federal and state level, you can calculate your net worth, and you’ll start to see if you are likely to have a taxable estate.

Remember to consider the impact of your life insurance—if you die, the death benefit can become part of your estate, too. If you suspect you will have a taxable estate, it is a great idea to work with an estate planning attorney.

Taxable estates under U.S. federal tax rules

The threshold for taxation that the U.S. federal government sets is called the “basic exclusion amount.” You can find it on the IRS website, and it is updated every year for inflation. In 2026, the basic exclusion amount is $15 million per person, and a married couple can combine their individual exemptions, so it’s effectively $30 million per married couple in 2026.

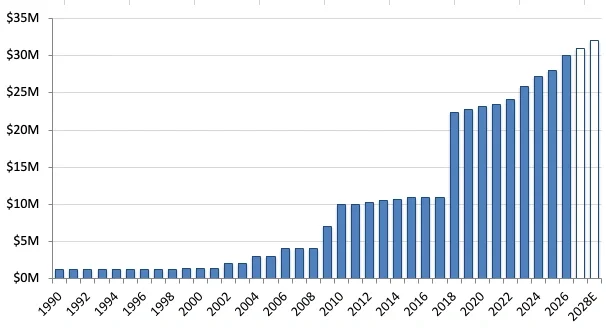

The current estate tax exemptions are at historically high levels.

Basic Exclusion Amount for Federal Estate Taxes - Per Couple

Many people do not have a taxable estate under federal rules today, but that could easily change as the rules change, so it is good to keep an eye on what is happening with the basic exclusion amount.

What is the U.S. federal estate tax?

When you have a taxable estate at the federal level, you pay estate tax on the amount of the estate that is above the basic exclusion amount. Currently, the estate tax rate is at 40%, a low level compared to historical levels.

Federal Estate Tax % Rate in the U.S.

Taxable estates under state tax rules

While the majority of states have no estate tax and no inheritance tax whatsoever, 17 states plus Washington, D.C., do.

The thresholds in some states are quite low, particularly if you include life insurance. In some state, the exemptions are only $1 million or $2 million dollars. Many people who may not consider themselves wealthy can end up with a taxable estate.

Here is a helpful map to see what rules apply to you if there’s a state estate tax or inheritance tax where you live.

|

Estate Tax (12) |

Inheritance Tax (5) |

Both (1) |

|

|

|

Source: https://taxfoundation.org/state-estate-tax-state-inheritance-tax-2020/

What should I do if I have a taxable estate?

When you have (or expect you will likely have) a taxable estate, it is best to consider your options with qualified advisors. Here at AboveBoard we can help you explore insurance strategies, and we highly recommend doing so in conjunction with an estate planning attorney and (if you have one) your financial advisor.

If you do not yet have an estate planning attorney you love working with, we are happy to offer ideas of candidates you can interview. We also make referrals to financial advisors who embody the smart and ethical approach to their work that we apply to ours.

Get a life insurance quote to start exploring your options.