No one likes hidden fees or unexpected charges. If you are considering a life insurance policy, it’s important to understand if the premiums can go up in the future. When you compare pricing, you need to look at the premiums today as well as premiums over the entire time that you expect to have the policy.

Surprisingly, many people who have annual renewable term life insurance do not even know it. That is often because it goes by another name, such as “term until age 80.” One large mutual insurance company sells a lot of these “term until age 80” bait-and-switch insurance policies. We meet a lot of clients who come to us when their insurance premiums are getting shockingly expensive and they are looking for better options.

What is annual renewable term life insurance?

Annual renewable term life insurance is insurance that increases in cost each year. The insurance company must renew your coverage (even if your health deteriorates) up until the expiration of the policy, but the renewal will be at increasing rates.

Annual renewable term starts out looking like a great deal when you are younger but ends up being much more expensive when you are older.

How does annual renewable term compare to level term?

Short answer: not favorably.

All the policies you will see on AboveBoard’s online quotes are “level term” policies, meaning the premiums are fixed and cannot change for the length of the term: 20 year term premiums stay the same for 20 years, 30 year term premiums stay the same for 30 years, and so on. While we can certainly help you get annual renewable term if that is truly what you want, we find that most people are better off with a level term policy.

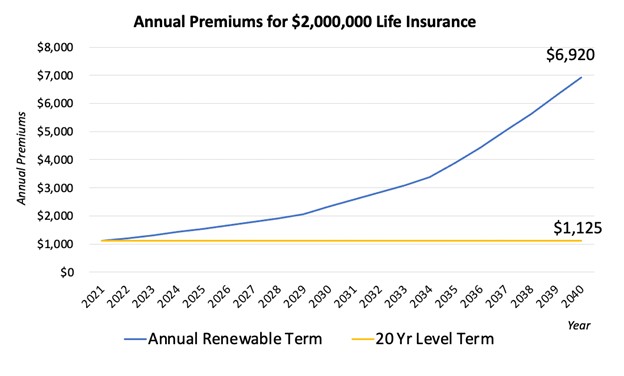

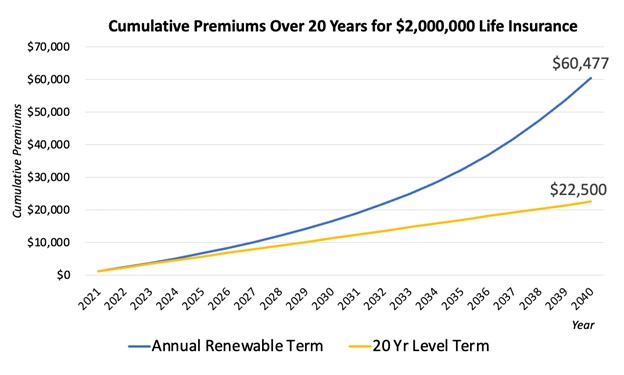

Recently, a 37-year-old new mom came to us looking to better understand her existing coverage. She had been sold a “term until age 80” policy with a large mutual insurance carrier. Here’s how it compared to a 20 year level term policy—yikes!

Her annual renewable term policy saved nothing whatsoever in per-year premiums, since it started out at the same rate as a 20 year level term policy and got more expensive over time.

It looked even worse when we compared how her premiums would add up over time.

Sometimes, the annual renewable term policy looks better than level term premiums in the beginning, but that is not a good reason to get it - the increases will really catch up with you.

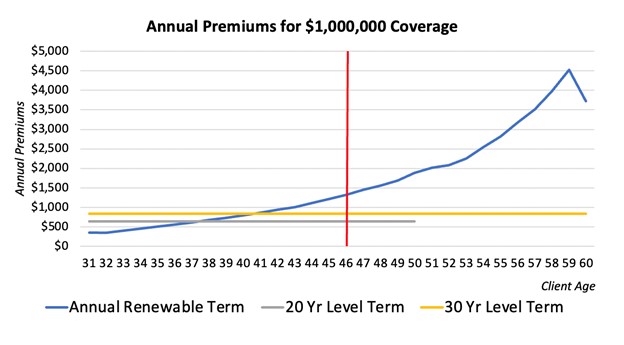

A 46-year-old dad sought our advice when his annual renewable term had gotten very expensive. He bought the policy 15 years ago when he was just starting to expand his family, and a reliable broker should have steered him toward 20 or 30 year term life. Instead, he was put into a “term until age 80” plan, which often happens when the agent is looking to make a quick sale without taking into account the client’s long-term well-being or when they are laying the groundwork to push the client into an ill-chosen whole life policy at a later time.

Comparing annual premiums for the same amount of annual renewable, 20 year level term, or 30 year level term showed that this dad had already lost a lot of money paying for increasing premiums. Thankfully he remained in excellent health and better options were available to him.

When is annual renewable term life insurance a good idea?

Annual renewable term can be helpful if you need coverage for a very short period of time. A good rule of thumb is 7 years or less, but even then you should compare the cost to a 10 year level term policy.

Here are some examples of when annual renewable term can be useful:

- You are the CEO or other key executive of an early-stage company and your investors want you to have life insurance for only a few years (e.g. 2-5 years)

- You are required to carry life insurance under a divorce decree for a short period of time

If you need coverage for longer than 7 years, you are most likely better off looking at level term policies. Pretty much all carriers offer 10, 15, 20, and 30 year terms, while some carriers also offer 25, 35, and 40 year terms.

How to compare your annual renewable term coverage to level term

If you already have or are considering an annual renewable term policy, or “term until age 80,” here’s how to evaluate the costs over time:

1a) If you already have an annual renewable term policy, contact the insurance carrier and say, “please send me an in-force illustration of my term policy that clearly explains what my premiums could be in the future.”

1b) If you’re considering a new annual renewable term policy, ask the agent to send an illustration that clearly shows what your premiums could be in the future.

2) Get an online quote from AboveBoard (for level term coverage)

3) Email us your annual renewable term policy—we’ll run the comparison for you!

If you prefer to do-it-yourself for step #3, the important thing is to look at the premiums over the entire time you expect to have the coverage. Create a table with the data shown in the graphs above, comparing what happens year-by-year.

Be very skeptical about anyone who tells you “you’ll be making more money by then, so don’t worry about it.” We often see young families that are navigating the high costs of childcare, and, even though their incomes are higher than when they bought the renewable term policies, the ever-escalating premiums are a real burden.

Take action: Don’t let bad insurance decisions drag you down. If you already have an annual renewable term policy, you don’t have to stick with it. If you haven’t bought a policy yet, we want you to be empowered to do an honest cost comparison. We’re here if you’re ready for help choosing the right policy for your long-term needs.